SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant tounder§240.14a-12 |

|

Fortune Brands Innovations, Inc. |

Fortune Brands Home & Security, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box)all boxes that apply): |

| |

| ☒ | | No fee required. |

| |

☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies:

|

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ☐ | | Fee paid previously with preliminary materials.materials |

| |

| ☐ | | Check box if any part of the fee is offset as providedFee computed on table in exhibit required by Item 25(b) per Exchange Act Rule0-11(a)(2)Rules14a-6(i)(1) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid:

|

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | | | |

| | (3) | | Filing Party:

|

| | | | |

| | (4) | | Date Filed:

|

| | | | 0-11 |

520 Lake Cook Road, Deerfield, Illinois 60015

NOTICE OF ANNUAL MEETING

AND PROXY STATEMENT

Dear Fellow Stockholders:

We are pleased to invite you to the 20182023 Annual Meeting of Stockholders (“Annual Meeting”) of Fortune Brands Home & Security,Innovations, Inc. (“Fortune Brands” or “the Company”) on Tuesday, May 1, 201816, 2023 at 8:00 a.m. (CDT) at the Renaissance Chicago North Shore Hotel, 933 Skokie Boulevard, Northbrook,520 Lake Cook Road, Deerfield, Illinois. The following matters will be considered at the Annual Meeting:

| | |

| Proposal 1: | | Election of the three director nominees identified in this Proxy Statement for a three yearthree-year term expiring at the 20212026 Annual Meeting of Stockholders (see pages6-9) 6-11); |

| |

| Proposal 2: | | Ratification of the appointment by the Company’s Audit Committee of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 20182023 (see page 45)53); |

| |

| Proposal 3: | | Advisory vote to approve the compensation paid to the Company’s named executive officers (see page 46)54); |

| |

| Proposal 4: | | Advisory vote to approve the frequencyApproval of voting on the compensation paidan amendment to the Company’s named executiveRestated Certificate of Incorporation to provide exculpation of officers (see page 47)55); and |

such other business as may properly come before the Annual Meeting.

Stockholders of record at the close of business on March 2, 2018,17, 2023, the record date for the Annual Meeting, are entitled to vote.Stockholders who wish to attend theFor information about attending our Annual Meeting in person should review theand for voting instructions, beginning on page 1.please see pages 59-63.

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE. See pages1-5 for voting instructions.

This Notice of Annual Meeting and Proxy Statement and accompanying proxy are first being distributed on or about March 14, 2018.30, 2023.

|

|

| Hiranda S. Donoghue |

|

Robert K. Biggart |

SeniorExecutive Vice President, General CounselChief Legal Officer and Corporate Secretary |

Important Notice Regarding the Availability of Proxy Materials

for the 20182023 Annual Meeting of Stockholders to be Held on Tuesday, May 1, 2018.16, 2023.

This Notice of Annual Meeting and Proxy Statement and the Annual Report on Form10-K for the fiscal year ended December 31, 20172022 (“Form10-K”) are available atwww.proxyvote.comwww.proxyvote.com.

FREQUENTLY ASKED QUESTIONS

Why did I receive these materials?

These materials were provided to you in connection with the solicitation by the Board of Directors (the “Board”) of Fortune Brands Home & Security, Inc. (“Fortune Brands” or the “Company”) of proxies to be voted at our Annual Meeting Information

| | | | | | | | | | | | |

| | Time and Date | |  | | Location* | |  | | | Record Date | |

| | Tuesday, May 16, 2023 at 8:00 a.m. (CDT) | | | | 500 Corporate Center Starlight Cafe entrance 520 Lake Cook Road, Deerfield, Illinois | | | | | March 17, 2023 | |

Agenda and at any adjournment or postponement of the Annual Meeting. The Annual Meeting will take place on May 1, 2018 at 8:00a.m. (CDT) at the Renaissance Chicago North Shore Hotel, 933 Skokie Boulevard, Northbrook, Illinois. Voting Recommendations

This Proxy Summary highlights selected information in this Proxy Statement describes the matters on which you, as a stockholder, are entitled to vote and gives youdoes not contain all of the information that you need to make an informed decision on these matters.

Why did I receive a “Notice of Internet Availability of Proxy Materials” instead of printed proxy materials?

Companies are permitted to provide stockholders with access to proxy materials over the Internet instead of mailing a printed copy. Unless we were instructed otherwise, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to stockholders. The Notice contains instructions onshould consider in deciding how to accessvote. Please read the proxy materials oncomplete Proxy Statement carefully before voting. The following table summarizes the Internet, how to vote and how to request a printed set of proxy materials. This approach reduces the environmental impact and our costs of printing and distributing the proxy materials, while providing a convenient method of accessing the materials and voting.

The Company will make its Annual Report on Form10-K for the last fiscal year, including any financial statements or schedules, available to stockholders without charge, upon written request to the Secretary, Fortune Brands Home & Security, Inc., 520 Lake Cook Road, Deerfield, Illinois 60015. The Company will furnish exhibits to Form10-K to each stockholder requesting them upon payment of a $.10 per page fee to cover the Company’s cost.

Can I get electronic access to the proxy materials if I received printed materials?

Yes. If you received printed proxy materials, you can also access them online atwww.proxyvote.combefore voting your shares. The Company’s proxy materials are also available on our website athttp://ir.fbhs.com/annuals-proxies.cfm. Stockholders are encouraged to elect to receive future proxy materials electronically. If you opt to receive our future proxy materials electronically, you will receive an email next year with instructions containing a link to view those proxy materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it or for as long as the email address provided by you is valid. Stockholders of record who wish to participate can enroll athttp://enroll.icsdelivery.com/fbhs. If your shares are held in an account by a bank, broker or other nominees, you should check with your bank, broker or other nominee regarding the availability of this service.

What is the difference between being a stockholder of record and a beneficial owner?

If your shares are registered directly in your name with EQ Shareholder Services, the Company’s transfer agent, you are the “stockholder of record.” If your shares are held in an account by a bank, broker or other nominee, you hold your shares in “street name” and are a “beneficial owner” of those shares. The majority of stockholders are beneficial owners. For such shares, a bank, broker or other nominee is considered the stockholder of record for purposes of voting at the Annual Meeting. Beneficial owners have the right to direct their bank, broker or other nominee on how to vote the shares held in their account by using the voting instructions provided by the bank, broker or other nominee.

Who is entitled to vote?

Only stockholders who owned the Company’s common stock of record at the close of business on March 2, 2018 (the “Record Date”) are entitled to vote. Each holder of common stock is entitled to one vote per share. There were 148,018,012 shares of common stock outstanding on the Record Date.

FREQUENTLY ASKED QUESTIONS (CONTINUED)

Who can attend the Annual Meeting?

Only stockholders who owned Fortune Brands’ common stock as of the close of business on the Record Date, or their authorized representatives, may attend the Annual Meeting. At the entrance to the meeting, stockholders will be asked to present valid photo identification to determine stock ownership on the Record Date. If you are acting as a proxy, you will need to submit a valid written legal proxy signed by the owner of the common stock.You must bring such evidence with you to be admitted to the Annual Meeting.

Stockholders who own their shares in “street name” will be required to submit proof of ownership at the entrance to the meeting. Either your voting instruction card or brokerage statement reflecting your stock ownership as of the Record Date may be used as proof of ownership.

What mattersitems that will be voted on at the Annual Meeting?

Four matters will be considered at theour 2023 Annual Meeting of Stockholders (the “Annual Meeting”), along with the Board’s voting recommendations.

| | | | | | |

Proposal

Number | | Description of Proposal | | Board Recommendation | | Page

Number |

| | | | |

1 | | Election of three Class III Directors Nicholas I. Fink, A.D. David Mackay and Stephanie Pugliese | | FOR each Nominee | | 6-11 |

| | | | |

2 | | Ratify the appointment of the independent auditor Pricewaterhouse Coopers for 2023 | | FOR | | 53 |

| | | | |

3 | | Advisory vote to approve named executive officer compensation | | FOR | | 54 |

| | | | |

4 | | Approval of an amendment to the Restated Certificate of Incorporation to provide for exculpation of officers | | FOR | | 55 |

See pages 59-63 for instructions on how to vote your shares.

BUSINESS HIGHLIGHTS

Our 2022 Transformation

2022 was a transformative year for our Company. It was also a challenging year for our Company and the market for our products. In the second half of 2022, the market experienced a sudden slow down, driven by higher interest rates and affordability concerns, which are:impacted Company results. In addition, the Company was also impacted by continued inflation and inventory pressures as we saw typical seasonality return to the business. Notwithstanding this challenging environment, our teams delivered a significant transformation of our businesses. We also took decisive actions to reduce our fixed cost base and to preserve our margin while maintaining investments in our key strategic initiatives, including our digital transformation, brand-building, and incremental capacity critical to our long-term growth. Our team executed the following transformational initiatives during 2022:

| | • | | We completed the separation of MasterBrand, Inc., our cabinets business (“MasterBrand”), via a tax-free spin-off (the “Separation”) well-ahead of our timing expectations. We expect that the Separation will unlock greater shareholder value for both companies by allowing us to focus on and invest in our unique growth opportunities. |

1

|

PROXY SUMMARY (CONTINUED) |

We rebranded our Company with a new identity to reflect our evolution as a business focused on driving accelerated growth in our categories through brand and innovation. Our name was changed to Fortune Brands Innovations, Inc. and our NYSE ticker symbol is now FBIN.

We reorganized the Company from a decentralized structure to a more aligned operating model to prioritize activities that are core to brand, innovation, and channel. This change also placed our global supply chain resources under one leadership team to fully leverage the scale and execution of our total business.

| • | | We acquired Solar Innovations, a leading producer of wide-opening exterior door systems and outdoor enclosures, further expanding our outdoor living product portfolio; Aqualisa, a UK leading manufacturer of smart digital shower products, strengthening our connected product offerings; and we finalized the Flo Technologies acquisition after our multi-year phase-in. |

We preserved margins in the face of a challenging macroeconomic environment.

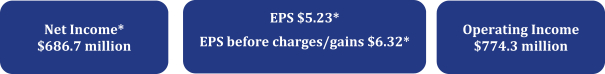

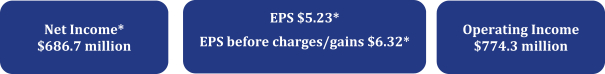

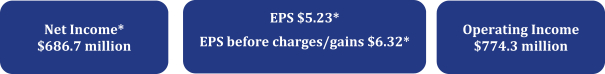

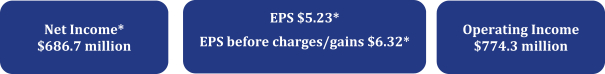

Amidst a challenging external macro environment that negatively impacted our results, we believe that our teams’ strong performance executing our transformative initiatives, while reducing cost and increasing efficiency, has positioned the Company for long-term growth. Our 2022 results were:

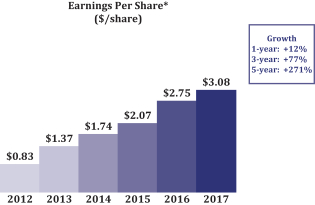

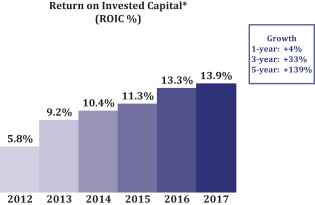

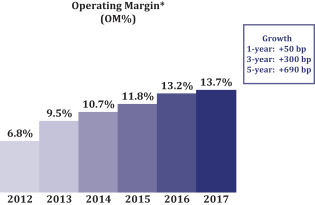

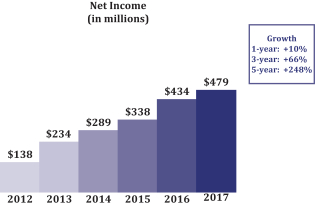

| * | Attributable to Fortune Brands (inclusive of Cabinets). Please refer to Appendix A for a reconciliation of earnings per share on a before charges/gains basis to GAAP earnings per share. |

The New Fortune Brands: Fortune Brands Innovations, Inc.

Fortune Brands Innovations is powered by our brands, innovation, and service that provides a unique value to our customers. Following the Separation, our product portfolio is focused on Water, Outdoors and Security, and is now more heavily weighted toward smaller ticket repair and remodel items and less exposed to market cyclicality. Our focus on innovative products and operations are drivers of our growth, productivity enhancement, and margin expansion. Our category management expertise and strong customer relationships enables us to provide greater consistency and pricing discipline.

| | |

| Water Innovations | | Outdoors & Security |

| |

| Water Innovations is an industry leader with a powerful collection of water brands and focused on developing the future of water for today’s consumers. Water Innovations designs, manufactures, markets and distributes a growing portfolio of connected products, water management offerings, as well as consumer plumbing products, including faucets, showers, sinks and tubs. | | The Outdoors & Security segment is focused on driving growth in the attractive outdoor living space with products engineered for performance, providing homeowners protection and security. The segment’s products include a collection of digitally connected security products, as well as exterior entryway, storm, security and screen doors; eco-friendly synthetic decking, cladding and railing; retractable screens and porch windows; safety and security devices. |

| |

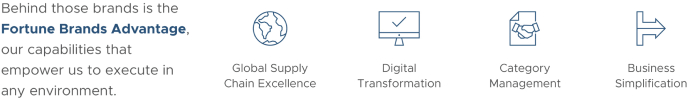

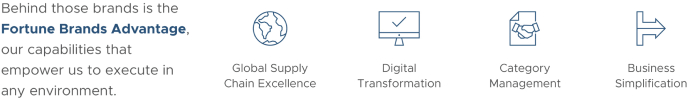

| |  |

We believe the Fortune Brands Advantage, a set of unifying capabilities leveraged across the Company, enables us to drive category management performance, simplify workstreams to better enable efficiencies, reduce costs by leveraging our global supply chain and enable the advancement of our digital strategy and capabilities.

2

|

PROXY SUMMARY (CONTINUED) |

We continue to be driven by our culture of doing the right thing, as evidenced by our safety records, Environmental, Social and Governance (“ESG”) programs and our focus on innovating products that help address some of the world’s most pressing sustainability and safety issues.

BOARD OF DIRECTORS

| | | | | | | | | | |

| 2023 Director Nominees – Class III – Term Expiring 2026 |

| Name and Principal Occupation | | Age | | Director

Since | | Independent | | Board Committees | | Other Public Company Boards |

Nicholas I. Fink Chief Executive Officer of Fortune Brands | | 48 | | 2020 | | | | Executive | | Constellation Brands, Inc. |

| |

Stephanie Pugliese Former President, Americas, Under Armour, Inc. | | 52 | | 2023 | | ✓ | | Audit Nominating, Environmental, Social & Governance | | None |

| |

A. D. David Mackay Former Chairman and Chief Executive Officer, Kellogg Company | | 67 | | 2011 | | ✓ | | Audit Compensation (Chair) | | The Clorox Company |

SUCCESSION AND REFRESHMENT In accordance with the Board’s retirement age policy, the Board did not nominate Mr. Thomas to stand for re-election at the Annual Meeting. In anticipation of Mr. Thomas’ retirement from the Board, our Board welcomed Stephanie Pugliese as a Class III director in March 2023, following a thoughtful and comprehensive board succession planning process led by our Nominating, Environmental, Social & Governance Committee (the “NESG Committee”). Ms. Pugliese’s experience as a commercial and strategic business leader with oversight of digital and e-commerce businesses at Under Armour, Inc. and Duluth Holdings, Inc. brings valuable perspective to our Board. Ms. Pugliese is serving on our Audit Committee and NESG Committee.

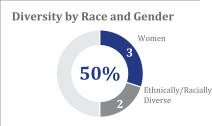

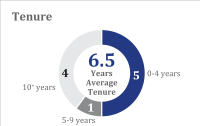

The addition of Ms. Pugliese to our Board increases the Board’s diversity. Following Mr. Thomas’ retirement from our Board in May 2023, our Board composition will be:

3

|

PROXY SUMMARY (CONTINUED) |

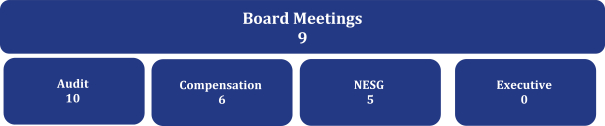

CORPORATE GOVERNANCE HIGHLIGHTS

Our Board is committed to maintaining a strong corporate governance program designed to promote the long-term interests of our stockholders and strengthen Board and management accountability. As a company, we are committed to core values that reflect a strong culture of integrity and accountability. These practices are reflected in our corporate governance policies, which are described in more detail on pages 12-20 of the Proxy Statement and highlighted below:

| | |

| |

| Independent Board (90%), except our CEO | | Independent Chair of the Board |

| |

| Three women and two ethnically/racially diverse directors (50% of the Board members are diverse following Mr. Thomas’ retirement) | | Regular executive sessions of non-management directors |

| |

| Majority vote in uncontested director elections, with a resignation policy | | Proxy access bylaw allows for 3% stockholders to nominate the greater of two directors or 20% of the board |

| |

| The Board has a policy that it generally will not re-nominate a director for election following her or his 72nd birthday | | Five new Board members added since 2019 demonstrating the Board’s commitment to Board refreshment and succession planning |

| |

Active engagement and oversight by Board of three Class ICompany strategies and risks | | Board oversight of ESG programs and related risks and publication of ESG report |

| |

Robust stock ownership guidelines for directors identified in this Proxy Statement (Proposal 1and prohibition on hedging and pledging of Company stock | | Annual Board and committee evaluations |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE HIGHLIGHTS

Our Board of Directors is committed to overseeing our ESG initiatives throughout Fortune Brands. We dedicate significant resources toward developing innovative products that positively impact the lives of our consumers, and to produce these products using increasingly sustainable methods. We are committed to being a good corporate citizen by ensuring high safety standards for our associates, fostering an inclusive culture and giving back to our larger communities. We believe that the high standards by which we conduct our business will help us to build on our strengths and continually improve how we measure and monitor our progress on ESG-related initiatives.

| | | | |

Our philosophy is to have a holistic ESG program, integrated throughout our businesses, that focuses on what matters to our Company and its stakeholders, with the goal of continual improvement. |

Safety Safety is integral to Company culture and is a top priority, as reflected in our goal of zero safety incidents and through our efforts to create an injury-free workplace.

Diversity, Equity& Inclusion (“DEI”)We continued to advance our DEI strategy and initiatives during 2022. Recent additions to the Company’s leadership team shows the Board’s and management’s commitment to increasing representation of professionals of color and women. In addition, we expanded our employee resource groups and continued to offer unconscious bias learning programs throughout the organization during 2022. We are committed to making employment data publicly available to our stakeholders and will make our EE0-1 report available on our website later this year and following our next filing with the U.S. Equal Employment Opportunity Commission.

4

|

PROXY SUMMARY (CONTINUED); |

Please see the resources available on our website at https://www.fbin.com/corporate-responsibility/esg-reporting. Our 2022 ESG Report will be available on our website in the second quarter of 2023. Information provided on the Company’s website is not incorporated by reference into this Proxy Statement.

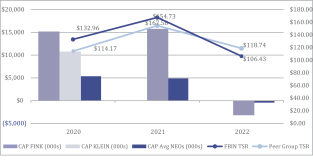

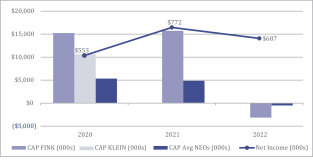

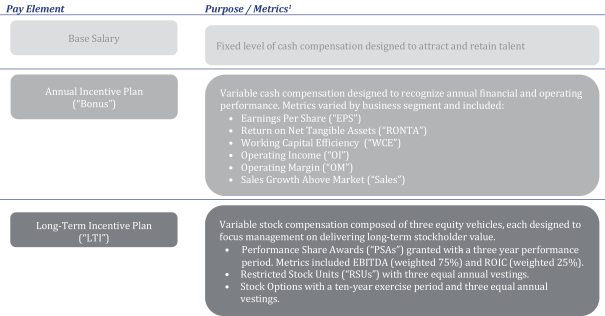

COMPENSATION HIGHLIGHTS

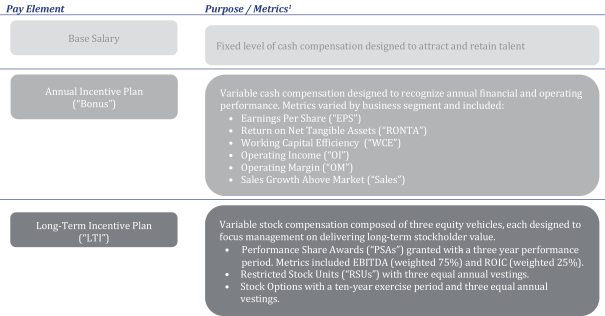

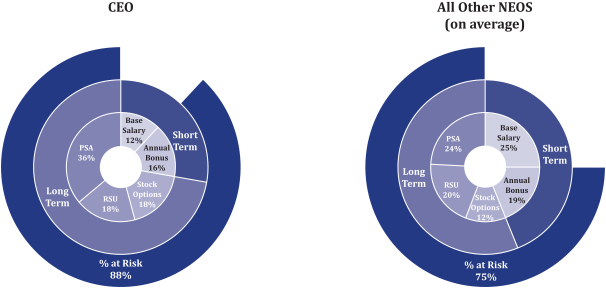

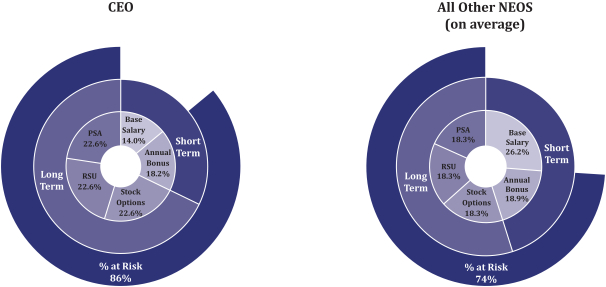

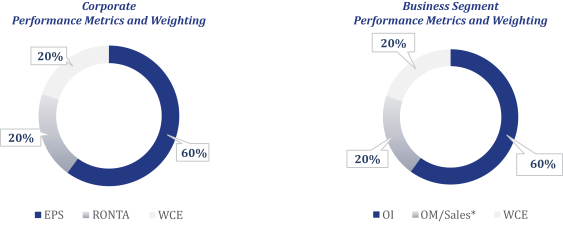

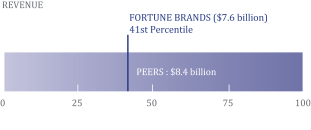

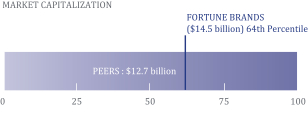

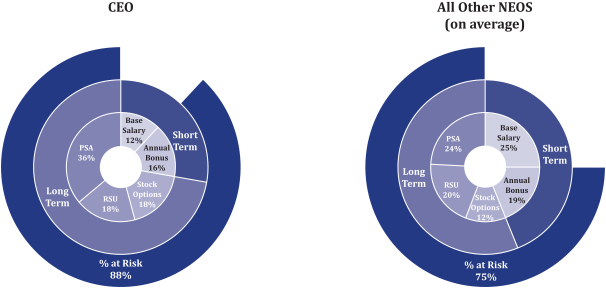

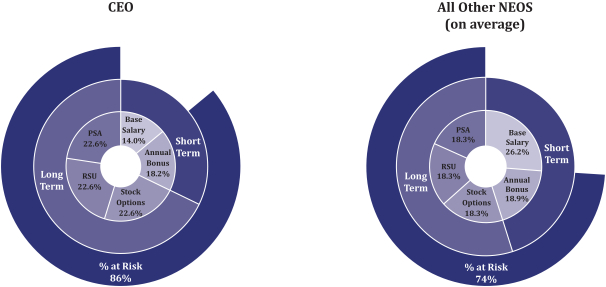

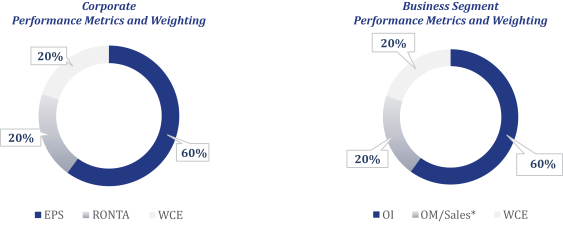

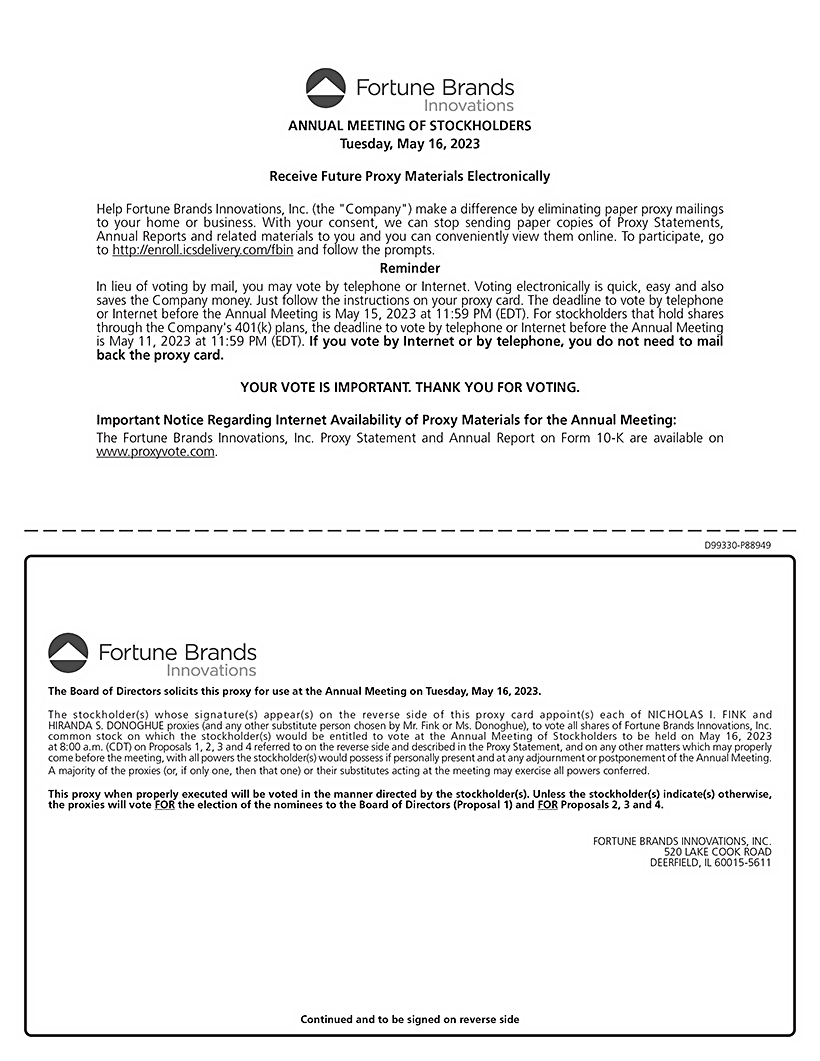

PAYFOR PERFORMANCEOur executive compensation program is designed to reward named executive officers (“NEOs”) for the achievement of both strategic and operational goals that support the creation of long-term stockholder value. The vast majority of each NEO’s annual target compensation is at-risk because most compensation paid to our NEOs is dependent upon Company performance and/or stock price. In 2022:

| • | | 88% of the CEO’s total target compensation was pay-at-risk; |

| | • | | ratification75% of the appointmentother NEOs’ (on average) total target compensation was pay-at-risk; and

|

50% of the annual equity awards granted to NEOs in 2022 were granted in the form of performance share awards (“PSAs”) with vesting based on three-year performance targets.

| | |

Over the past five years, our stockholders have overwhelmingly supported our executive compensation program, with an average approval of our independent registered public accounting firm(Proposal 2);approximately 93% of the votes cast for the Company’s annual say on pay vote. COMPENSATION PRACTICESThe Compensation Discussion & Analysis (“CD&A”) section beginning on page 23 includes additional detail on the following compensation highlights: | |  |

| | |

| | • |

| Long-term focus and stockholder alignment through equity compensation | | advisory voteNo problematic pay practices and historically strong stockholder support for say on pay (93% average over the last five years)

|

| |

| Robust stock ownership guidelines | | Prohibition on hedging and pledging of Company stock |

| |

Executive compensation subject to approve the compensation paid to the Company’s named executive officers(Proposal 3); anda clawback policy | | No single trigger change in control severance arrangements |

| |

| Limited perquisites | | No excise tax gross ups |

5

| • | |

advisory vote to approve the frequency of voting on the compensation paid to the Company’s named executive officers (Proposal 4).

PROPOSAL 1 – ELECTIONOF DIRECTORS |

How do I vote?

If you received a Notice in the mail, you can either vote by (i) Internet (www.proxyvote.com) or (ii) in person at the Annual Meeting. Voting instructions are provided on the Notice. You may also request to receive printed proxy materials in the mail.

Stockholders who received printed proxy materials in the mail can vote by (i) filling out the proxy card and returning it in the postage paid return envelope, (ii) telephone(800-690-6903), (iii) Internet (www.proxyvote.com), or (iv) in person at the Annual Meeting. Voting instructions are provided on the proxy card.

Stockholders who received proxy materials electronically can vote by (i) Internet (www.proxyvote.com), (ii) telephone(800-690-6903), or (iii) in person at the Annual Meeting.

If you are not the stockholder of record, but are a beneficial owner of our shares, you must vote by giving instructions to your bank, broker or other nominee. You should follow the voting instructions on the form that you receive from your bank, broker or other nominee, which will include details on available voting methods.To be able to vote in person at the Annual Meeting, you must obtain a legal proxy from your bank, broker or other nominee in advance and present it to the Inspector of Election with your completed ballot at the Annual Meeting.

How will my proxy be voted?

Your proxy card, when properly signed and returned to us, or processed by telephone or via the Internet, and not revoked, will be voted in accordance with your instructions. If any matter is properly presented other than the four proposals described above, the persons named in the enclosed proxy card or, if applicable, their substitutes, will have discretion to vote your shares in their best judgment.

FREQUENTLY ASKED QUESTIONS (CONTINUED)

What if I don’t mark the boxes on my proxy or voting instruction card?

Unless you give other instructions on your proxy card or your voting instruction card, or unless you give other instructions when you cast your vote by telephone or the Internet, the persons named in the enclosed proxy card will vote your shares in accordance with the recommendations of the Board, which areFORthe election of each director named in Proposal 1,FOR Proposals 2 and 3 andONE YEAR for the frequency of the advisory vote to approve the compensation of the Company’s named executive officers (Proposal 4).

If you hold shares beneficially and you have not provided voting instructions, your bank, broker or other nominee is only permitted to use its discretion and vote your shares on certain routine matters (Proposal 2). If you have not provided voting instructions to your bank, broker or other nominee onnon-routine matters (Proposals 1, 3 and 4), your bank, broker or other nominee is not permitted to use discretion and vote your shares.Therefore, we urge you to give voting instructions to your bank, broker or other nominee on all four proposals.Shares that are not permitted to be voted by your bank, broker or other nominee with respect to any matter are called “brokernon-votes.” Brokernon-votes are not considered votes for or against a proposal and will have no direct impact on the voting results, but will be counted for the purposes of establishing a quorum at the Annual Meeting.

How many votes are needed to approve a proposal?

The nominees for director, innon-contested elections, must receive a majority of the votes cast at the Annual Meeting, in person or by proxy, to be elected. A proxy card marked to abstain on the election of a director and any brokernon-votes will not be counted as a vote cast with respect to that director.

Under the Company’s majority vote Bylaw provision relating to the election of directors, if the number of votes cast “for” a director nominee does not exceed the number of votes cast “against” the director nominee, then the director must tender his or her resignation from the Board promptly after the certification of the stockholder vote. The Board (excluding the nominee in question) will decide within 90 days of that certification, through a process managed by the Nominating and Corporate Governance Committee, whether to accept the resignation. The Board’s explanation of its decision will be promptly disclosed in a filing with the Securities and Exchange Commission (“SEC”).

The affirmative vote of shares representing a majority in voting power of the common stock, present in person or represented by proxy at the Annual Meeting, and entitled to vote is necessary for the approval of Proposals 2 and 3.

For Proposal 4, stockholders may vote in favor of holding the vote to approve the compensation paid to the Company’s named executive officers every one year, every two years or every three years and they may also choose to abstain. The option of every one year, every two years or every three years that receives the highest number of votes cast by stockholders will be considered by the Board as the stockholders’ recommendation as to the frequency of future advisory votes on executive compensation.

Proxy cards marked to abstain on Proposals 2 and 3 will have the effect of a negative vote. Proxy cards marked to abstain on Proposal 4 will have no effect on the outcome. Brokernon-votes are not applicable to Proposal 2 because your bank, broker or other nominee will be permitted to use discretion to vote your shares on this proposal. Brokernon-votes will have no impact on Proposals 1, 3 and 4.

How can I revoke my proxy or change my vote?

You may revoke your proxy by giving written notice to the Secretary of the Company or by delivering a later dated proxy at any time before it is actually voted. If you voted on the Internet or by telephone, you may change your vote by voting again. Your last vote is the vote that will be counted. Attendance at the Annual Meeting does not revoke your proxy unless you vote at the Annual Meeting.

FREQUENTLY ASKED QUESTIONS (CONTINUED)

Will my vote be public?

As a matter of policy, proxies, ballots and tabulations that identify individual stockholders are not publicly disclosed, but are available to the independent Inspector of Election and certain employees of the Company.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority in voting power of the issued and outstanding shares of common stock entitled to vote will constitute a quorum. Proxies received but marked as abstentions or without any voting instructions will be included in the calculation of the number of shares considered to be present at the Annual Meeting.

Our Board is soliciting this proxy. The Company will bear the expense of soliciting proxies for this Annual Meeting, including mailing costs. To ensure that there is sufficient representation at the Annual Meeting, our employees may solicit proxies by telephone, facsimile or in person.

What if I am a participant in the Fortune Brands Home & Security Retirement Savings Plan or the Fortune Brands Home & Security Hourly Employee Retirement Savings Plan?

Participants who invest in the Fortune Brands Stock Fund through the Fortune Brands Home & Security Retirement Savings Plan and the Fortune Brands Home & Security Hourly Employee Retirement Savings Plan (collectively, the “Savings Plans”) were mailed a Notice. The Trustee of the Savings Plans, as record holder of the Fortune Brands common stock held in the Savings Plans, will vote whole shares attributable to your interest in the Fortune Brands Stock Fund in accordance with your directions. Follow the voting instructions provided in the Notice to allow the Trustee to vote the whole shares attributable to your interest in accordance with your instructions. If the Trustee does not receive timely voting instructions with respect to the voting of your shares held in the Fortune Brands Stock Fund, the Trustee will vote such shares in the same manner and in the same proportion as the shares for which the Trustee did receive voting instructions.

How can I eliminate multiple mailings to the same address?

If you and other residents at your mailing address are registered stockholders and you receive more than one copy of the Notice, but you wish to eliminate the duplicate mailings, you must submit a written request to the Company’s transfer agent, EQ Shareowner Services. To request the elimination of duplicate copies, please write to EQ Shareowner Services, 1110 Centre Pointe Curve, Suite 101, Mendota Heights, Minnesota 55120.

If you and other residents at your mailing address own shares in street name, your broker, bank or other nominee may have sent you a notice that your household will receive only one Notice or one set of proxy materials for each company in which you hold stock through that broker, bank or other nominee. This practice, known as “householding,” is designed to reduce our printing and postage costs. If you did not respond, the bank, broker or other nominee will assume that you have consented, and will send only one copy of the Notice to your address. You may revoke your consent to householding at any time by sending your name, the name of your brokerage firm, and your account number to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. The revocation of your consent to householding will be effective 30 days following its receipt. In any event, if you did not receive an individual copy of the Notice or proxy materials, or if you wish to receive individual copies of such documents for future meetings, we will send an individual copy to you if you call Shareholder Services at (847)484-4538, or write to the Secretary of Fortune Brands Home & Security, Inc., 520 Lake Cook Road, Deerfield, Illinois 60015.

FREQUENTLY ASKED QUESTIONS (CONTINUED)

How can I submit a stockholder proposal or nomination next year?

Our Bylaws provide that in order for a stockholder to (i) nominate a candidate for election to our Board at the 2019 Annual Meeting of Stockholders, or (ii) propose business for consideration at the 2019 Annual Meeting of Stockholders, written notice containing the information required by the Bylaws must be delivered to the Secretary of the Company no less than 90 days nor more than 120 days before the anniversary of the prior year’s Annual Meeting, that is, after January 1, 2019 but no later than January 31, 2019 for the 2019 Annual Meeting.

Under SEC rules, if a stockholder wishes to submit a proposal for possible inclusion in the Company’s 2019 proxy statement pursuant to Rule14a-8 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), we must receive it on or before November 14, 2018.

The person presiding at the Annual Meeting is authorized to determine if a proposed matter is properly brought before the Annual Meeting or if a nomination is properly made.

Copies of our Restated Certificate of Incorporation and Bylaws are available upon written request to the Secretary, Fortune Brands Home & Security, Inc., 520 Lake Cook Road, Deerfield, Illinois 60015.

PROPOSAL 1 – ELECTIONOF DIRECTORS

Summary of Qualification of Directors

The Board believeshas identified certain qualifications that are required of all directors must possessdirectors. Additionally, the Board seeks to maintain a considerable amountdiverse set of educationskills, knowledge, experiences, backgrounds and business management experience. The Board also believes that it is necessary for each of the Company’s directors to possess certain general qualities, while there are other skills and experiences that should beviewpoints represented on theour Board as a whole, but not necessarily by each individual director.

General qualities for all directors:Qualifications Required of All Directors

Extensive executive leadership experience

Excellent business judgment

| | | | | | | | | | |

| Experience | | | | | Personal Attributes | | | |

• Considerable amount of education | | | | | | • Excellent business judgment | | | | |

• Extensive executive leadership experience or business management experience | | | | | | • Strong commitment to the Company’s goal of maximizing stockholder value | | | | |

• Knowledge about issues affecting, or that may in the future affect, the Company | | | | | | • High level of integrity and ethics | | | | |

Specific Qualifications, Expertise and ethics

Strong commitment to the Company’s goal of maximizing stockholder value

Specific experiences, qualifications, and backgrounds to be representedKey Skills Represented on the Board as a whole:

|

| Qualifications, Expertise and Key Skills |

• Consumer products expertise • Financial and/or accounting expertise • Public company experience as a chief executive, chief operating or chief financial officer • Public company board experience • Diversity of skill, background, race, gender and viewpoint |

Financial and/or accounting expertise

Consumer products expertise

Knowledge of international markets

Chief executive officer/chief operating officer/chief financial officer experience

Extensive board experience

Diversity of skill, background and viewpoint

The process used by the Nominating and Corporate Governance Committee in recommending qualified director candidates is described below under Corporate Governance – Director Nomination Process (see page 6 of this Proxy Statement).

Election of Class I Directors

The Board currently consists of eight11 members and is divided into three classes, each having three yearthree-year terms that expire in successive years. Ms. Stephanie Pugliese was appointed by the Board to serve as a Class III Director effective in March 2023. The term of theeach director currently serving in Class I directorsIII (Messrs. Nicholas I. Fink, A.D. David Mackay, David M. Thomas and Ms. Pugliese) expires at the 2018 Annual Meeting of Stockholders.Meeting. The Board has nominated Messrs. Fink and Mackay and Ms. Ann F. Hackett, Mr. John G. Morikis and Mr. Ronald V. Waters, III, each of whom is currently serving as a Class I director, forre-electionPugliese for a new term of three years expiring at the 20212026 Annual Meeting of Stockholders and until their successors are duly elected and qualified. Shares cannot be votedMr. Thomas will not stand for more thanre-election and will retire immediately following the Annual Meeting. Mr. Thomas has served as a valuable member of our Board since 2011, serving in positions as non-executive chairman, lead independent director and chair of the NESG Committee over the course of his tenure. We thank him for his dedicated service to the Company and the Board. Following Mr. Thomas’ retirement, the number of nominees proposed forre-election.directors will be reduced from 11 to 10 members.

Each of the nominees has consented to be named as a nominee and to serve as a director, if elected. If any of them should become unavailable to serve as a director (which is not now expected), the Board may designate a substitute nominee. In that case, the persons named in the enclosed proxy card will vote for the substitute nominee designated by the Board. Shares cannot be voted for more than the number of nominees proposed for re-election.

The names of the nominees (Class III) and the current Class III and Class IIIII directors, along with their present positions, their principal occupations and employment during the last five years, any directorships held with other public companies or registered investment firms during the past five years, their ages and the year first elected as a director of the Company, are set forth below. IndividualEach director’s individual qualifications and experiences of our directors that contribute to the Board’s effectiveness as a whole are also described in the following paragraphs.

PROPOSAL 1 – ELECTIONOF DIRECTORS (CONTINUED)

6

| | | | | | | | | | |

Name | | Present positions and offices with the Company, principal

occupations and other directorships

during the past five years | | Age | | | Year

first

elected

director | |

NOMINEES FOR DIRECTOR – CLASS I DIRECTORS – TERM EXPIRING 2021 | |

| | | |

Ann F. Hackett | | Partner andco-founder of Personal Pathways, LLC, a company providingweb-based enterprise collaboration platforms, since 2015. Prior to that, President of Horizon Consulting Group, LLC, a strategic and human resource consulting firm founded by Ms. Hackett in 1996. Currently also a director of Capital One Financial Corporation. Formerly a director of Beam Inc. | | | 64 | | | | 2011 | |

|

Ms. Hackett has extensive experience in leading companies that provide strategic, organizational and human resource consulting services to boards of directors and senior management teams. She has experience leading change initiatives, risk management, talent management and succession planning and in creating performance- based compensation programs, as well as significant international experience and technology experience. Ms. Hackett also has extensive board experience and currently serves as the lead independent director of Capital One Financial Corporation. | |

| | | |

John G. Morikis | | President and Chief Executive Officer since January 2016 and Chairman since January 2017 of The Sherwin-Williams Company, a manufacturer of paint and coatings products. President and Chief Operating Officer from 2006 to January 2016. Currently a director of The Sherwin-Williams Company. | | | 54 | | | | 2011 | |

|

| Mr. Morikis’ experience as a Chief Executive Officer and as a Chief Operating Officer of The Sherwin-Williams Company, and his more than 30 years of experience with a consumer home products company, brings to our Board the perspective of a leader who faces similar external economic issues that face our Company. | |

| | | |

Ronald V. Waters, III | | Retired since May 2010; President and Chief Executive Officer of LoJack Corporation, a provider of tracking and recovery systems, from January 2009 to May 2010. Currently also a director of HNI Corporation and Paylocity Holding Corporation. Formerly a director of Chiquita Brands International, Inc. | | | 65 | | | | 2011 | |

|

| Mr. Waters has considerable executive leadership and financial management experience. He served as Chief Executive Officer and Chief Operating Officer at LoJack Corporation, a premier technology company, and as Chief Operating Officer and Chief Financial Officer at Wm. Wrigley Jr. Company, a leading confectionary manufacturing company. Mr. Waters also has extensive board experience. | |

|

PROPOSAL 1 – ELECTIONOF DIRECTORS (CONTINUED) |

|

2023 NOMINEES FOR ELECTION - CLASS III DIRECTORS – TERM EXPIRING 2026 |

| | |

| | Director since: 2020 Age: 48 Committees: Executive Biography: Chief Executive Officer of Fortune Brands Innovations, Inc. since January 2020; President & Chief Operating Officer of Fortune Brands from March 2019 to January 2020; President of Fortune Brands Global Plumbing Group from August 2016 to March 2019. Current Public Company Boards: Constellation Brands, Inc. |

|

Skills & Qualifications Mr. Fink’s leadership as Chief Executive Officer of the Company and his significant international and consumer brand and business operating experience, as well as his mergers and acquisitions and strategy expertise provide him with intimate knowledge of our operations, the opportunities for growth and the challenges faced by the Company. He joined the Company as Senior Vice President, Global Growth & Corporate Development in June 2015 and held several leadership positions within the Company’s operations prior to being named Chief Executive Officer in 2020. Mr. Fink has successfully navigated the Company and its leaders through the COVID-19 pandemic and continues to transform our Company for future growth. Prior to joining Fortune Brands, Mr. Fink held key leadership positions at Beam Suntory, Inc., including President of Asia Pacific/South America of Beam Suntory, Inc., a global spirits company. |

| | |

| | Director since: 2011 Independent Age: 67 Committees: Audit, Compensation (Chair); Executive Biography: Retired since January 2011; President and Chief Executive Officer of Kellogg Company, a packaged foods manufacturer, prior thereto. Current Public Company Boards: The Clorox Company |

|

Skills & Qualifications Mr. Mackay held various key executive positions with Kellogg Company including Chief Executive Officer and Chief Operating Officer, bringing to our Board the perspective of a leader who faced a similar set of external economic, social and governance issues to those that face our Company. Mr. Mackay also has significant international business experience, as well as extensive board experience. His prior Board experience serving as both an executive Chairman (Kelllogg Co.) and non-executive Chairman (Beam, Inc.) on public company boards and his previous leadership roles provide him with expertise in executive compensation and succession planning matters. Mr. Mackay also serves on the boards of several non-profit organizations. |

7

|

PROPOSAL 1 – ELECTIONOF DIRECTORS (CONTINUED) |

| | |

| | Director since: 2023 Independent Age: 52 Committees: Audit; NESG Biography: Former President, Americas of Under Armour, Inc., a global sportswear brand, from September 2019 to March 2023; President and Chief Executive Officer of Duluth Holdings, Inc., a U.S. retailer of casual wear, workwear, and accessories from November 2015 to September 2019. Former Public Company Boards: Duluth Holdings, Inc. |

|

Skills & Qualifications Ms. Pugliese held various key executive positions with Under Armour, Inc. and Duluth Holdings, Inc., bringing to our Board the perspective of a leader who has had international commercial, operational, and strategic responsibilities including oversight for digital and e-commerce businesses and marketing. She has served as a public company chief executive officer and board member of Duluth Holdings, Inc. |

The Board of Directors recommends that you vote FOR the election of each nominee named above.

PROPOSAL 1 – ELECTIONOF DIRECTORS (CONTINUED)

|

CLASS I DIRECTORS – TERM EXPIRING 2024 |

| | | | | | | | | | |

Name | | Present positions and offices with the Company, principal

occupations and other directorships

during the past five years | | Age | | | Year

first

elected

director | |

|

CLASS II DIRECTORS – TERM EXPIRING 2019 | |

| | | |

Susan S. Kilsby | | Retired since May 2014; Senior Advisor at Credit Suisse AG, an investment banking firm, from 2009 to May 2014; Managing Director of European Mergers and Acquisitions of Credit Suisse prior thereto. Currently also a director of Shire Plc, BBA Aviation PLC and Goldman Sachs International.Formerly a director of Keurig Green Mountain, Inc., and Coca-Cola HBC AG. | | | 59 | | | | 2015 | |

|

| Ms. Kilsby has a distinguished global career in investment banking and brings extensive mergers and acquisitions and international business experience to the Board. In addition to her experience at Credit Suisse, she held a variety of senior positions with The First Boston Corporation, Bankers Trust and Barclays de Zoete Wedd. Ms. Kilsby also has extensive board experience and currently serves as thenon-executive Chair of Shire Plc. | |

| | | |

Christopher J. Klein | | Chief Executive Officer of the Company since January 2010. President and Chief Operating Officer prior thereto. Currently also a director of Thor Industries, Inc. | | | 54 | | | | 2010 | |

|

| Mr. Klein’s leadership as Chief Executive Officer of the Company and his significant corporate strategy, business development and operational experience provide him with intimate knowledge of our operations and the challenges faced by the Company. Mr. Klein led the Company through thespin-off from Fortune Brands, Inc. in 2011. Prior to the Company’sspin-off, he held several leadership positions at Fortune Brands, Inc., helping to reshape the business through acquisitions and divestitures. Prior to joining Fortune Brands, Mr. Klein held key strategy and operating positions at Bank One Corporation and also served as a partner at McKinsey & Company, a global management consulting firm. | |

PROPOSAL 1 – ELECTIONOF DIRECTORS (CONTINUED)

| | |

| | Director since: 2011 Independent Age: 69 Committees: Compensation; NESG Biography: Retired since January 2020. Strategy Consulting Partner and Co-founder of Personal Pathways, LLC, a company providing web-based enterprise collaboration platforms, from 2015 through January 2020. Prior to her role at Personal Pathways, she was President of Horizon Consulting Group, LLC, a strategic and human resource consulting firm founded by Ms. Hackett in 1996. Current Public Company Boards: Capital One Financial Corporation and MasterBrand, Inc. |

|

Skills & Qualifications: Ms. Hackett has extensive experience in leading companies that provided strategic, organizational and human resource consulting services to boards of directors and senior management teams. She has experience leading change initiatives, risk management, talent management and succession planning and in creating performance-based compensation programs, as well as significant international experience and technology experience. Ms. Hackett also has extensive international experience, including spending years working in the United Kingdom, Africa and Switzerland. Ms. Hackett also has extensive board experience, including serving as chair of two other public company compensation committees and three other public company governance committees. She also serves as the lead independent director of Capital One Financial Corporation. |

| | | | | | | | | | |

Name | | Present positions and offices with the Company, principal

occupations and other directorships

during the past five years | | Age | | | Year

first

elected

director | |

|

CLASS III DIRECTORS – TERM EXPIRING 2020 | |

| | | |

A.D. David Mackay | | Retired since January 2011; President and Chief Executive Officer of Kellogg Company, a packaged foods manufacturer, prior thereto. Currently also a director of The Clorox Company. Formerly a director of Keurig Green Mountain, Inc., McGrath Limited, Woolworths Limited and Beam Inc. | | | 62 | | | | 2011 | |

|

| Mr. Mackay held various key executive positions with Kellogg Company including Chief Executive Officer and Chief Operating Officer, bringing to our Board the perspective of a leader who faced a similar set of external economic, social and governance issues to those that face our Company. Mr. Mackay also has significant international business experience, as well as extensive board experience. | |

| | | |

David M. Thomas | | Retired since March 2006; Chairman of the Board and Chief Executive Officer of IMS Health Incorporated, a provider of information services to the pharmaceutical and healthcare industries, prior thereto. Currently also a director of The Interpublic Group of Companies, Inc. and a member of the Fidelity Investments Board of Trustees. | | | 68 | | | | 2011 | |

|

| Mr. Thomas’ experience as a Chief Executive Officer of IMS Health Incorporated and his management experience at premier global technology companies, including as Senior Vice President and Group Executive of IBM, helps the Board address the challenges the Company faces due to rapid changes in IT capabilities and communications and global distribution strategies. Mr. Thomas also has extensive board experience. | |

| | | |

Norman H. Wesley | | Retired since October 2008; Chairman of the Board and Chief Executive Officer of Fortune Brands, Inc. prior thereto. Currently also a director of Acuity Brands, Inc. and Acushnet Holdings Corp. Formerly a director of Keurig Green Mountain, Inc. and ACCO Brands Corporation. | | | 68 | | | | 2011 | |

|

| Mr. Wesley’s experience as Chief Executive Officer of a consumer products conglomerate gives him unique insights into the Company’s challenges, opportunities and operations. Mr. Wesley also has extensive board experience. | |

|

PROPOSAL 1 – ELECTIONOF DIRECTORS (CONTINUED) |

| | |

| | Director since: 2011 Independent Age: 59 Committees: Audit; Compensation Biography: Chairman since January 2017 and Chief Executive Officer since January 2016 of The Sherwin-Williams Company, a manufacturer of paint and coatings products. President and Chief Operating Officer of The Sherwin-Williams Company prior thereto. Current Public Company Boards: The Sherwin-Williams Company |

|

Skills & Qualifications: Mr. Morikis’ experience as a Chief Executive Officer and a Chief Operating Officer of The Sherwin-Williams Company, and his more than 30 years of experience with a consumer home products company, brings to our Board the perspective of a leader who faces similar external economic issues that face our Company. His experience actively serving as Chairman and Chief Executive Officer of The Sherwin-Williams Company also provides him with valuable insight into board operations and provides him with expertise into accounting, executive compensation and succession planning and ESG matters. Mr. Morikis also serves on the board of the Joint Center for Housing Studies of Harvard University and other non-profit organizations. |

| | |

| | Director since: 2020 Independent Age: 57 Committees: Audit; NESG Biography: Founder and CEO of Lead Mandates LLC, a business and leadership advisory firm; Retired since October 2020 from Ernst & Young LLP, a leading global professional services firm, where he served as EY Global Client Service Partner for major consumer product accounts from April 2014 to October 2020 and as Americas Operational Transaction Services Practice Leader prior thereto. Current Public Company and Registered Investment Company Boards: MasterBrand, Inc. and Equitable Funds |

|

Skills & Qualifications: Mr. Perry has extensive experience as a strategic, operational and financial advisor helping boards of directors and management teams. He held several senior positions with Ernst & Young and A.T. Kearney Inc. and is the founder and Chief Executive Officer of Lead Mandates LLC. Mr. Perry brings to our Board relevant experience and perspectives in mergers, acquisitions, integrations, divestitures, business transformations and consumer products. He serves as chair of the NESG Committee of MasterBrand, Inc. and as a Board member of the Chicago Chapter of the National Association of Corporate Directors and other non-profit organizations. |

9

|

PROPOSAL 1 – ELECTIONOF DIRECTORS (CONTINUED) |

| | |

| | Director since: 2011 Independent Age: 70 Committees: Audit (Chair); NESG; Executive Biography: Retired since May 2010; President and Chief Executive Officer of LoJack Corporation, a provider of tracking and recovery systems, prior thereto. Current Public Company Boards: Paylocity Holding Corporation Former Public Company Boards: HNI Corporation |

Skills & Qualifications: Mr. Waters has considerable executive leadership and financial management experience and brings significant financial and accounting expertise to our Board. He served as Chief Executive Officer and Chief Operating Officer at LoJack Corporation, a premier technology company, and as Chief Operating Officer and Chief Financial Officer at Wm. Wrigley Jr. Company, a leading confectionary manufacturing company. Mr. Waters also has extensive board experience, including by serving on the compensation committee of Paylocity Holding Corporation and the audit committee of HNI Corporation and Paylocity Holding Corporation. |

|

CLASS II DIRECTORS – TERM EXPIRING 2025 |

| | |

| | Director since: 2015 Independent, Non-Executive Chair Age: 64 Committees: Compensation; NESG; Executive (Chair) Biography: Retired since May 2014; Senior Advisor at Credit Suisse AG, an investment banking firm, prior thereto. Current Public Company Boards: Diageo plc and Unilever plc Former Public Company Boards: Shire plc, Goldman Sachs International, BBA Aviation plc, BHP Group plc and BHP Limited |

|

Skills & Qualifications Ms. Kilsby has a distinguished global career in investment banking and brings extensive mergers and acquisitions, finance and international business experience to the Board. In addition to serving as a Senior Advisor, Ms. Kilsby also served as Managing Director of European Mergers and Acquisitions at Credit Suisse. She also held a variety of senior positions with The First Boston Corporation, Bankers Trust and Barclays de Zoete Wedd. Ms. Kilsby also has extensive board experience, including serving as Chair of Shire plc for five years. She also serves on multiple non-profit boards and as a member of the Takeover Panel, a UK independent body that regulates takeovers in the United Kingdom for the purpose of ensuring fair treatment for shareholders and an orderly framework for takeover bids. Her extensive history of board and committee service provides her with expertise in board oversight and function of its committees. |

10

|

PROPOSAL 1 – ELECTIONOF DIRECTORS (CONTINUED) |

| | |

| | Director since: 2020 Independent Age: 54 Committees: Audit; Compensation Biography: Vice Chair and Chief Financial Officer of Kellogg Company, a packaged foods manufacturer, from January 2023 to Present; Senior Vice President and Chief Financial Officer of Kellogg Company from July 2019 to January 2023; President - Asia Pacific, Middle East, Africa of Kellogg Company from March 2012 to July 2019. |

|

Skills & Qualifications Mr. Banati has extensive executive leadership, operations and financial management experience in leading consumer products companies, both domestically and internationally, working extensively across the Asia Pacific region, particularly in Australia, India, China, Japan, Korea, Southeast Asia and Singapore. He brings to our Board the perspective of a leader with extensive international experience in the consumer products industry. As the Chief Financial Officer of Kellogg Company, he also brings significant financial and accounting expertise to our Board. |

| | |

| | Director since: 2019 Independent Age: 65 Committees: Compensation; NESG Biography: Retired since April 2018; Consultant to the CEO of The Coca-Cola Company, a beverage company, from January 2018 to March 2018; Executive Vice President of The Coca-Cola Company and President of Coca-Cola Bottling Investments Group, a bottling operations company, from August 2004 to December 2017. Current Public Company Boards: Smurfit Kappa Group plc Former Public Company Boards: Coca-Cola Bottlers Japan Holdings, Inc. and Coca-Cola European Partners plc |

|

Skills & Qualifications Mr. Finan’s experience as an Executive Vice President of The Coca-Cola Company and President of its worldwide bottling operations, as well of his years of international consumer products experience, brings to our Board the perspective of a leader with extensive international operational leadership experience in the consumer products industry. Mr. Finan has extensive board experience, including serving as Chair of Smurfit Kappa Group plc. He also serves on multiple non-profit boards. |

11

Fortune Brands is committed to maintaining strong corporate governance practices that are good for our stockholders and our business.Company. We are dedicated to maintaining these practices and upholding high standards of conduct.

Corporate Governance Principles

The Board adoptedmaintains a set of Corporate Governance Principles which describe our corporate governance practices and address corporate governance issues such as Board composition and responsibilities, Board meeting procedures, the establishment of Board committees, management succession planning process and review of risks. The Corporate Governance Principles, which were enhanced in December 2022, most notably to include a Director Code of Conduct, are available athttp:https://ir.fbhs.com/corporate-governance.cfmir.fbin.com/governing-high-standards.

Director Independence

The Company’s Corporate Governance Principles provide that a majority of the members of the Board shall be independent directors. New York Stock Exchange requirements, as well as the Company’s committee charters, require that each member of the Audit, Compensation and Nominating and Corporate Governance Committees be independent. The Board applies the definition of independence found in the New York Stock Exchange Listed Company Manual in determining which directors are independent. When determining each director’s independence, the Board also considered charitable contributions made by the Company to organizations with which each director is affiliated.

| | |

The Company’s Corporate Governance Principles provide that a majority of the members of the Board shall be independent directors. New York Stock Exchange requirements, as well as the Company’s committee charters, require that each member of the Audit, Compensation and NESG Committees be independent. The Board applies |

| the definition of independence found in the New York Stock Exchange Listed Company Manual in determining which directors are independent. When determining each director’s independence, the Board also considered charitable contributions made by the Company to organizations with which each director is affiliated. The Company’s Corporate Governance Principles were enhanced in 2022 to ensure that each independent director promptly discloses to the Board any existing or proposed relationships or transactions that could impact his or her independence. | |  |

Applying that definition, Messrs. Banati, Finan, Mackay, Morikis, Perry, Thomas, Wesley and Waters and Mses.

Hackett, Kilsby and KilsbyPugliese were affirmatively determined by the Board to be independent. Due to Mr. Klein’sFink’s employment with the Company, he is not considered independent.

None of thenon-employee directors has any material relationship with the Company other than being a director and stockholder. Also, none of thenon-employee directors have participated in any transaction or arrangement that interferes with such director’s independence.

Policies with Respect to Transactions with Related Persons

The Board has adopted a Code of Business Conduct &and Ethics which sets forth various policies and procedures intended to promote the ethical behavior of all of the Company’s employees, officers and directors (the “Code of Conduct”). The Code of Conduct describes the Company’s policy on conflicts of interest. The Board has established a Compliance Committee (comprised of management) which is responsible for administering and monitoring compliance with the Code of Conduct.Conduct (other than monitoring director compliance which is the responsibility of the NESG Committee). The Compliance Committee periodically reports on the Company’s compliance efforts to the Audit Committee and to the Board.

The Board has also established a Conflicts of Interest Committee (comprised of management) which is responsible for administering, interpreting and applying the Company’s Conflicts of Interest Policy, which describes the types of relationships that may constitute a conflict of interest with the Company. Under the Conflicts of Interest Policy, directors and executive officers are responsible for reporting any potential related person transaction (as defined in Item 404 of RegulationS-K) to the Conflicts of Interest Committee in advance of commencing a potential transaction. The Conflicts of Interest Committee will present to the Audit Committee any potential related party transaction. The Audit Committee will evaluate the transaction, determine whether the interest of the related person is material and approve or ratify, as the case may be, the transaction. In addition, the Company’s executive officers and directors annually complete a questionnaire on which they are required to disclose any related person transactions and potential conflicts of interest. The General Counsel reviews the responses to the questionnaires, and, if a related person transaction is reported by a director or executive officer, submits the transaction for review by the Audit Committee. The Conflicts of Interest Committee also reviews potential conflicts of interest and reports findings involving any director of the Company to the Nominating and Corporate Governance Committee (the “Nominating Committee”). NESG Committee.

12

|

CORPORATE GOVERNANCE (CONTINUED) |

The NominatingNESG Committee will review any potential conflict of interest involving a member of the Board to determine whether such potential conflict would affect that director’s independence.

CORPORATE GOVERNANCE (CONTINUED)

Certain Relationships and Related Transactions

Since January 1, 2017,2022, the Company did not participate in any transactions in which any of its directors or executive officers, any immediate family member of a directorany of its directors or executive officerofficers, or any beneficial owner of more than 5% of the Company’s common stock, had a direct or indirect material interest.

Anti-Hedging and Anti-Pledging Policy

The Company has a policy prohibiting directors and executives from hedging or pledging Company stock, including Company stock held indirectly, and from engaging in any derivative transactions designed to offset the decrease or increase in the market value of the Company’s stock.

Board Refreshment and Succession

The Board believes that Board refreshment and director succession are important to ensuring that Board composition is aligned with the needs of the Company and the Board. The Board also believes that continuity is critical to the effectiveness of the Board as a group over time and allows directors to develop a deeper understanding of the Company. The NESG Committee assesses the composition of the Board and aims to strike a balance between Board members with longer term service and newer members who bring a fresh perspective.

As part of the Board’s succession planning process and in anticipation of Mr. Thomas’ retirement from the Board following the Annual Meeting, the Board appointed Stephanie Pugliese as a Class III director. The Board’s strong commitment to succession and refreshment have been demonstrated over the last four years by adding five new directors. The majority of the director appointments over this period of time also demonstrates the Board’s commitment to increasing racial and gender diversity.

Director Nomination Process

The NominatingNESG Committee is responsible for, among other things, screening potential director candidates, recommending qualified candidates to the Board for nomination, and assessing director independence.independence and evaluating whether the Board and its committees are functioning effectively.

When identifying director candidates, the NominatingNESG Committee determines whether there are any evolving needs that require an expert in a particular field or other specific skills or experiences. When evaluating director candidates, the NominatingNESG Committee first considers a candidate’s management experience and then considers issues of judgment, background, stature, leadership, conflicts of interest, integrity, ethics, original thinking and commitment to the goal of maximizing stockholder value.value, as well as diversity of background and experiences of the Board as a whole. The Nominating Committee also focuses on issues of diversity, such as diversity of gender, race and national origin, education, professional experience and differences in viewpoints and skills. The NominatingTo align with the Company’s DEI initiatives and investor priorities, the NESG Committee does not haveinstructed its search firm to include a formal policy withdiverse slate of candidates by including individuals that are diverse in gender and race when searching for new director candidates during 2022. Ms. Pugliese was identified as a potential director candidate through a third-party search firm. As a result of the Board’s succession planning process, the Board appointed an additional female director, increasing the Board’s gender diversity to 30% when taking into account Mr. Thomas’s planned retirement at the Annual Meeting.

With respect to diversity;the nomination of continuing directors for re-election, the individual’s contributions to the Board are considered. The Board generally will not re-nominate a director at the annual meeting of stockholders following his or her 72nd birthday; however, the Board andhas the Nominating Committee believediscretion to re-nominate a director after reaching age 72 if it believes that itnomination is essential thatin the best interest of the Company’s stockholders.

13

|

CORPORATE GOVERNANCE (CONTINUED) |

In connection with future director elections, or any time there is a vacancy on the Board, members representthe NESG Committee may retain a third-party search firm to assist in identifying qualified candidates who meet the needs of the Board at that time.The Board is committed to the inclusion of diverse viewpoints. Incandidats when conducting a director candidate search; however, in considering candidates for the Board, the NominatingNESG Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing directors forre-election, the individual’s contributions to the Board are also considered. For the purpose of this Annual Meeting, the Nominating Committee recommended the nomination of Ms. Hackett and Messrs. Morikis and Waters as Class I directors.

In connection with future director elections, or at any time there is a vacancy on the Board, the Nominating Committee may retain a third-party search firm to assist in locating qualified candidates that meet the needs of the Board at that time.

It is the NominatingNESG Committee’s policy to consider director candidates recommended by stockholders, if such recommendations are properly submitted to the Company. Stockholders that wish to recommend an individual as a director candidate for consideration by the NominatingNESG Committee can do so by writing to the Secretary of Fortune Brands Home & Security, Inc. at 520 Lake Cook Road, Deerfield, Illinois 60015. Recommendations must include the proposed nominee’srecommended candidate’s name, biographical data and qualifications, as well as other information that would be required if the stockholder were actually nominating the recommended candidate pursuant to the procedures for such nominations provided in our Bylaws. The NominatingNESG Committee will consider the candidate and the candidate’s qualifications in the same manner in which it evaluates nominees identified by the NominatingNESG Committee. The NominatingNESG Committee may contact the stockholder making the nominationrecommendation to discuss the qualifications of the candidate and the stockholder’s reasons for making the nomination.recommendation. Members of the NominatingNESG Committee may then interview the candidate if the committee deems the candidate to be appropriate. The NominatingNESG Committee may use the services of a third-party search firm to provide additional information about the candidate prior to making a recommendation to the Board. For a stockholder to directly nominate a candidate for director, such stockholder must follow the procedures set forth in the Company’s Bylaws.

The nomination process is designed to ensure that the NominatingNESG Committee fulfills its responsibility to recommend candidates that are properly qualified to serve the Company for the benefit of all of its stockholders, consistent with the standards established under the Company’s Corporate Governance Principles.

Board and Committee Evaluation Process

To increase the effectiveness and provide an opportunity to improve processes and effectiveness, the NESG and the Chair of the Board facilitate an annual evaluation of the Board and its committees. The evaluation typically includes both an interview of each director relating to topics including the function and culture of the Board and its committee’s and performance, the Board’s oversight, responsibilities and resources. In 2022, the Chair of the Board led this process, the results of which were discussed with the Board.

Director Orientation and Continuing Education

The Board is briefed regularly on a variety of topics such as industry updates, corporate governance developments, the Company’s regulatory environment, applicable federal securities and state corporate laws, financial principles and standard accounting procedures. In addition, the Corporate Governance Principles provide for the Company to make external continuing education opportunities available to directors and reimburse costs incurred while furthering their education. New directors participate in comprehensive orientation sessions that are designed to familiarize them with the Company’s strategic plans, operations, financial information and governance, among other relevant topics. This orientation program is considered an essential part of the director onboarding process. New director orientation is tailored to complement the background of the new director. These activities are designed to ensure that the Board remains knowledgeable about the most important issues affecting our Company and its businesses.

In 2022, several directors participated in external continuing education focused on a variety of topics, including corporate governance, ESG developments, leadership succession planning, the lead director function, audit committee functions, and enterprise risk management and innovation.

14

|

CORPORATE GOVERNANCE (CONTINUED) |

Communication with the Board

The Board and management encourage communication from the Company’s stockholders. Stockholders who wish to communicate with the Company’s management should direct their communication to the Chief Executive Officer or the Secretary of Fortune Brands Home & Security, Inc. at 520 Lake Cook Road, Deerfield,

CORPORATE GOVERNANCE (CONTINUED)

Illinois 60015. Stockholders, or other interested parties, who wish to communicate with thenon-management directors or any individual director should direct their communication c/o the Secretary at the address above. The Secretary will forward communications intended for the Board to the Chairman of the Board, or, if intended for an individual director, to that director. If multiple communications are received on a similar topic, the Secretary may, in his or her discretion, forward only representative correspondence. Any communications that are abusive, in bad taste or present safety or security concerns may be handled differently.

Board Leadership Structure

Mr. Thomas serves as the Company’snon-executive, independent Chairman. The Board of Directors has determined that having an independent director serve as Chairman of the Board is in the best interests of our stockholders to have an independent, non-executive chair serve as the Company’s Board Chair at this time. This leadership structure aids the Board’s oversight of management and allows our Chief Executive Officer to focus primarily on his management responsibilities. Thenon-executive Chairman Chair has the responsibility of presiding atover all meetings of the Board, consulting with the Chief Executive Officer on Board meeting agendas, acting as a liaison between management and thenon-management directors, including maintaining frequent contact with the Chief Executive Officer and advising him or her on the efficiency of the Board meetings, facilitating teamwork and communication between thenon-management directors and management, as well as additional responsibilities that are more fully described in the Company’s Corporate Governance Principles. In addition, the Company’snon-executive Chairman Chair facilitates the Board’s annual performance assessment of the Chief Executive Officer.

The Board does not believe that a single leadership structure is right at all times, so the Board periodically reviews its leadership structure to determine, based on the circumstances at the time, whether other leadership structures might be appropriate for the Company. The Board has been and remains committed to maintaining strong corporate governance practices and appropriate independent oversight of management. Given that eachIf, in the future, the Board appoints an executive chair or any other non-independent director as chair, the Board will elect an independent director to serve as the Lead Director. The duties of the membersChair of the Board other than Mr. Klein, is independent we believe that the leadership structure currently utilized by the Board provides effective independent Board leadership and oversight.Lead Director are further described in our Corporate Governance Principles.

Executive Sessions

Pursuant to the Company’s Corporate Governance Principles,non-management directors of the Board are required to meet on a regularly scheduled basis without the presence of management. Thenon-executive Chairman ofmanagement and are led by the Board leadsNon-Executive Chair. During 2022, Ms. Kilsby led these sessions. In addition, Board Committeescommittees also meet regularly in executive session without the presence of management.periodically as deemed appropriate by such committee.

Meeting Attendance

The Board of Directors met six times in 2017. Each director attended more than 75% of the total meetings of the Board and committees of the Board of which the director was a member during 2017. Pursuant to the Company’s Corporate Governance Principles, all directors are encouraged and expected to attend the Annual Meeting. All of the directors attended the Company’s 2017 Annual Meeting of Stockholders.

Risk Management